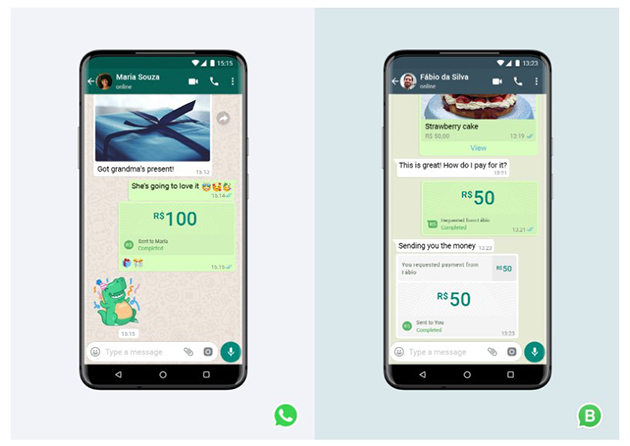

After years of facing legal hurdles, WhatsApp finally made an entry into the payment space last night. WhatsApp announced through a tweet, “Starting today, people across India will be able to send money through WhatsApp Pay. This secure payments experience makes transferring money just as easy as sending a message”.

Facebook and WhatsApp were waiting for the necessary approvals to make the payments service go live in India.

What is WhatsApp Pay?

WhatsApp works on Unified Payments Interface (UPI), the same system that Google Pay, Phone Pay, BHIM and various apps of banks use. So you do not need to hold any money in a Whatsapp ‘wallet’. The money is held in your bank account and the platform will simply help you transfer it to other people and vice versa. Whatsapp will create a fresh UPI ID when you register for payments. WhatsApp supports all popular banks like HDFC, ICICI, State Bank of India, Axis Bank and even Airtel Payments Bank.

How to register?

You will need to have a bank account and phone number linked to the account to enable payments on WhatsApp.

Using WhatsApp Pay to send money is as simple as sending photos and videos on the app. Payments can be made by clicking on the ‘attachments’ icon at the bottom of the screen that you would normally use to send photos, videos etc. WhatsApp will direct you to register first and ask for permission to make and use phone calls and read messages in order to complete the registration. In order to actually make a payment, you also need to set a UPI passcode. If you already have a UPI passcode with an existing UPI app then you can use the same code.

There’s a dedicated ‘Payments’ section available under the shortcut menu. Users can check their transactions, history and account details in this section.

How to set up WhatsApp Pay?

To start using WhatsApp Pay, a WhatsApp user needs to initiate a payment to a contact. Once the request is received, the user can set up their UPI account on WhatsApp. Users can then send and receive money on WhatsApp itself.

What are the modes of transaction on WhatsApp Pay?

During the initial phase, WhatsApp Pay allowed users to send money only to their contacts after which it enabled the UPI ID. Later in March WhatsApp also introduced QR code for its payments service. Each WhatsApp Pay user has a unique QR code which users can scan and send money.

Indian numbers only

WhatsApp Pay can only be used for Indian numbers linked to Indian bank accounts. People who have WhatsApp on their international numbers cannot use them.

Transaction limit and charges The transaction limit for ₹1 lakh for UPI also applies to Whatsapp. UPI is a free service and you will not be charged for transactions on it.